Foreign Trade Market: From Market Shifts to

Model Transformation

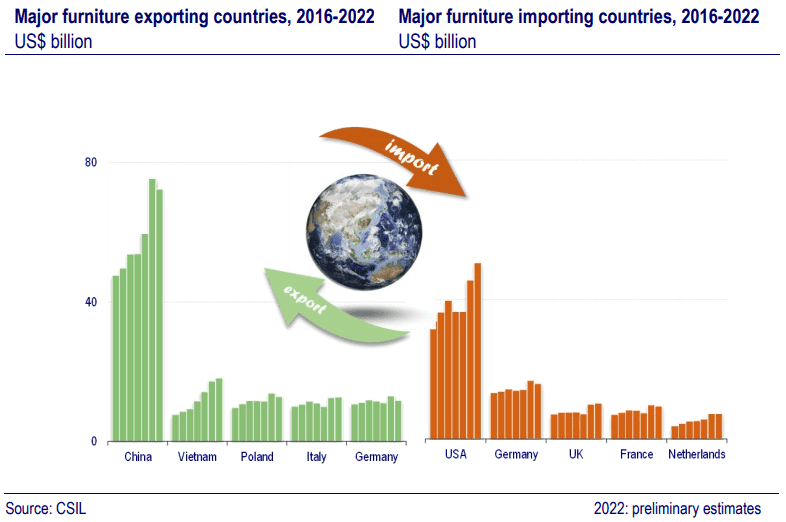

China is the world’s largest furniture

producer. According to CSIL’s World Furniture Outlook, China accounted for

nearly 40% of global furniture output in 2017, with exports representing

roughly one-third of total production capacity.

By 2025, however, furniture exports face a

new reality: tariff barriers, geopolitical tensions, and volatile shipping

costs have become the norm. More fundamentally, global industry division is

being reshaped, with higher environmental standards, compliance costs, and IP

protection weakening the viability of low-price, scale-driven growth.

1、Changes in Export Structure and Target

Markets

In the first three quarters of 2025, China’s furniture exports totaled

USD50.177 billion, down 4.6% year-on-year and broadly flat versus 2023 (CNFA).

Two key trends stand out:

(1)More diversified export markets

Data from Furniture Today shows that direct exports to the U.S. declined

steadily from 27.5% in 2022 to 23.3% in 2025, hitting a low of 17.3% in May

2025 before rebounding in October.

Meanwhile, exports to ASEAN countries are

rising sharply. OEC data shows the fastest growth in non-wood furniture

components from China to Vietnam, Malaysia, and Singapore between 2023 and

2024.

This trend is clearly reflected at CIFF

Guangzhou, where Southeast Asian buyers—especially from Vietnam and

Malaysia—now make up a growing share of procurement orders, offsetting declines

from Europe and the U.S.

(2)Cross-border e-commerce and bonded

logistics buck the trend

According to CNFA’s Q3 2025 report, while

general trade still dominates exports, its share is declining. Bonded logistics

and cross-border e-commerce reached USD3.757 billion, accounting for 7.5% of

exports—up over one percentage point from previous years.

This signals a shift away from bulk

shipments toward flexible, small-batch, fast-delivery models.

2、Opportunities Behind the Changes

(1)Growth potential in non-U.S. markets

While some export shifts are attributed to

transshipment, research suggests that only 30% of growth in non-U.S. markets

comes from short-term rerouting, with 70% driven by genuine demand growth

(Shenwan Hongyuan).

As urbanization accelerates and investment

rises in emerging economies, Chinese exporters must move from passive capacity

relocation toward proactive localization strategies.

(2)Cross-border e-commerce as a structural

growth engine

Despite skepticism, platforms such as

Wayfair, Amazon, Alibaba, and TEMU are rapidly increasing furniture penetration

worldwide. Platform investment and consumer behavior shifts make this trend

irreversible.

Furniture companies must treat cross-border

e-commerce not as a side channel, but as a way to build direct customer access,

brand presence, and data insight.

(3)Upgrading the global positioning of going

global

Low-price competition is no longer

sustainable. Long-term winners invest simultaneously in R&D, design,

patents, and branding, building defensible value.

Functional sofa ODMs that have strengthened

original design and patent portfolios now command stable premiums in North

America and Europe—pointing to a new normal for global expansion.

Reading Industry Change Through Exhibitions:

Greater Differentiation, Emerging Niche

Opportunities

In 2025, exhibition differentiation

accelerated. Ill-positioned shows saw declining participation, while leading

exhibitions continued attracting high-quality exhibitors.

1、From Style Showcases to Category Growth

Platforms

Trends now emerge first on social media,

with exhibitions serving as validation stages. More importantly, exhibitions

have become launchpads for high-growth categories such as functional sofas, modular

customization, and light premium customization.

Through sustained support for smart sleep,

wellness, and senior-friendly products, China International Furniture Fair

(Guangzhou) has helped shape multiple industry growth hubs.

2、Blurring Lines Between Domestic and Export

Markets

Domestic players are expanding overseas,

while export-focused firms explore local retail channels. Each faces capability

gaps—making exhibitions critical platforms for cross-market empowerment and

reduced trial-and-error costs.

March in Guangzhou:

A Forward-Looking Window into Industry

Opportunities

Pressure will persist, but opportunity lies

in structural change. As the first major exhibition of 2026, CIFF

Guangzhou—held March 18–21 (Home Furniture) and March 28–31 (Office, Commercial

& Machinery)—offers a key vantage point.

Under the theme ‘Chain Innovation’, the

2026 edition emphasizes sustainability, smart living, and aging-friendly

solutions, alongside design-driven value creation and global ecosystem

expansion.

For 2026, the message is clear: don’t

wait—act. Capture niche domestic demand, diversify export channels, embrace

cross-border e-commerce, and leverage exhibition platforms to integrate

resources and upgrade capabilities.

When change accelerates, decisive action is

the only way to uncover new growth—and win the future.