After a period of extraordinary growth followed by an inevitable correction, the global furniture industry enters 2025 in a state of cautious transition, currently navigating a complex landscape marked by both challenges and transformative trends.

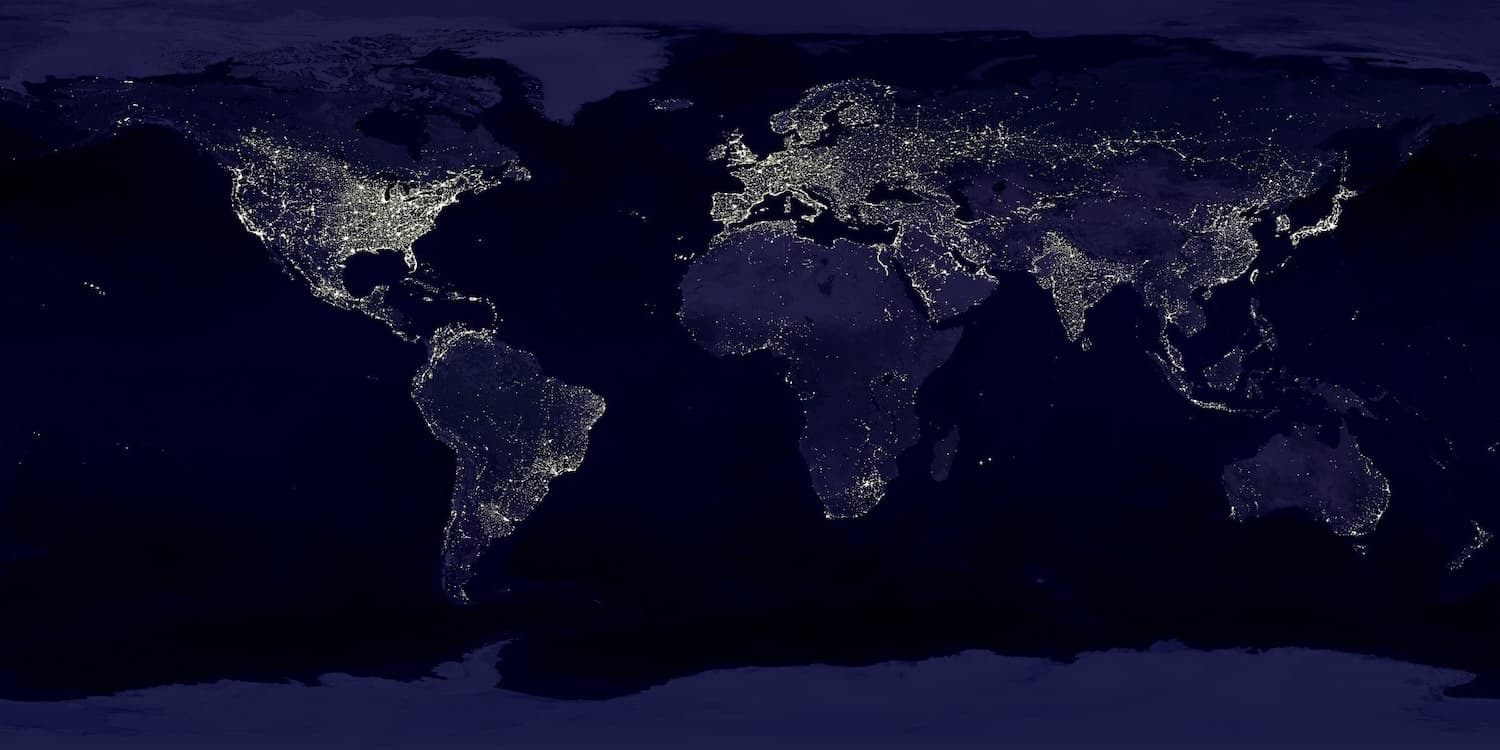

In 2024, according to CSIL, world furniture production reached approximately USD 470 billion, showing a stabilization after two years of decline. However, this stability masks varied regional performances. Asia-Pacific remains the dominant production hub, accounting for more than half of global output. China, while still the largest producer, experienced a modest return to growth after two years of contraction, thanks in part to the recovery of exports. India has emerged as the third-largest manufacturing country, reflecting the growing strength of its domestic market and expanding industrial base. In contrast, production in North America and Europe contracted, weighed down by weaker consumer demand and the lingering effects of inflation and tightening monetary policy.

Despite these headwinds, the furniture sector remains inherently global, with international trade having grown by +25% in the last ten years, reaching approximately USD 174 billion in 2024. However, this interconnectedness also brings vulnerability to protectionist trade policies, a factor amplified by the evolving trade landscape. The long-term implications of these developments are still unfolding, particularly in North America, where the reconfiguration of trade policy under the new U.S. administration introduces further unpredictability.

Looking ahead, CSIL forecasts a gradual recovery in global furniture consumption in 2025 and 2026. The path forward, however, will remain uneven across regions. Asia-Pacific is expected to continue as the primary engine of growth, underpinned by structural drivers such as population expansion, urbanization, and rising incomes. Europe is likely to remain in a fragile position, with only tentative signs of stabilization expected beyond 2025. North America may begin a gradual rebound, although much depends on the evolution of domestic policies and trade conditions. However, the outlook for world furniture trade suggests a slower recovery, with a growth of around 2% in 2025, followed by near stagnation in 2026.

The United States continues to play a central role in shaping the geography of global furniture trade. In recent years, U.S. furniture imports have shifted markedly. China, once accounting for over 40% of U.S. imports, now represents less than one-third. Vietnam has taken the lead, benefiting from both trade tensions between the U.S. and China and its strong export-oriented manufacturing base. Mexico is also gaining ground, supported by nearshoring strategies and regional trade agreements.

The spectre of evolving trade policies, particularly

tariffs, adds a layer of complexity to the outlook. The potential for increased

protectionist measures poses a significant downside risk to the global

furniture trade. While the immediate impact of a 10% tariff may be manageable

for many in the industry through supply chain adjustments and margin

compression, more substantial tariffs, such as the previously considered 46% on

Vietnam, could lead to likely price increases for consumers. While high-end

producers and domestically sourced manufacturers may be partially insulated,

the broader impact of these measures is likely to translate into increased

prices and, in some cases, product adjustments or cost-saving substitutions.

Even domestic manufacturers are not entirely immune, as many rely on globally

sourced raw materials and components. The uncertainty surrounding future US

trade policy is a major concern for the medium-term outlook, particularly for

North America. Historical examples, such as the US antidumping measures on

China in 2004 and subsequent tariffs, illustrate how trade policies can lead to

shifts in manufacturing locations, with Vietnam emerging as a significant

player. The current trade tensions are again influencing sourcing decisions.

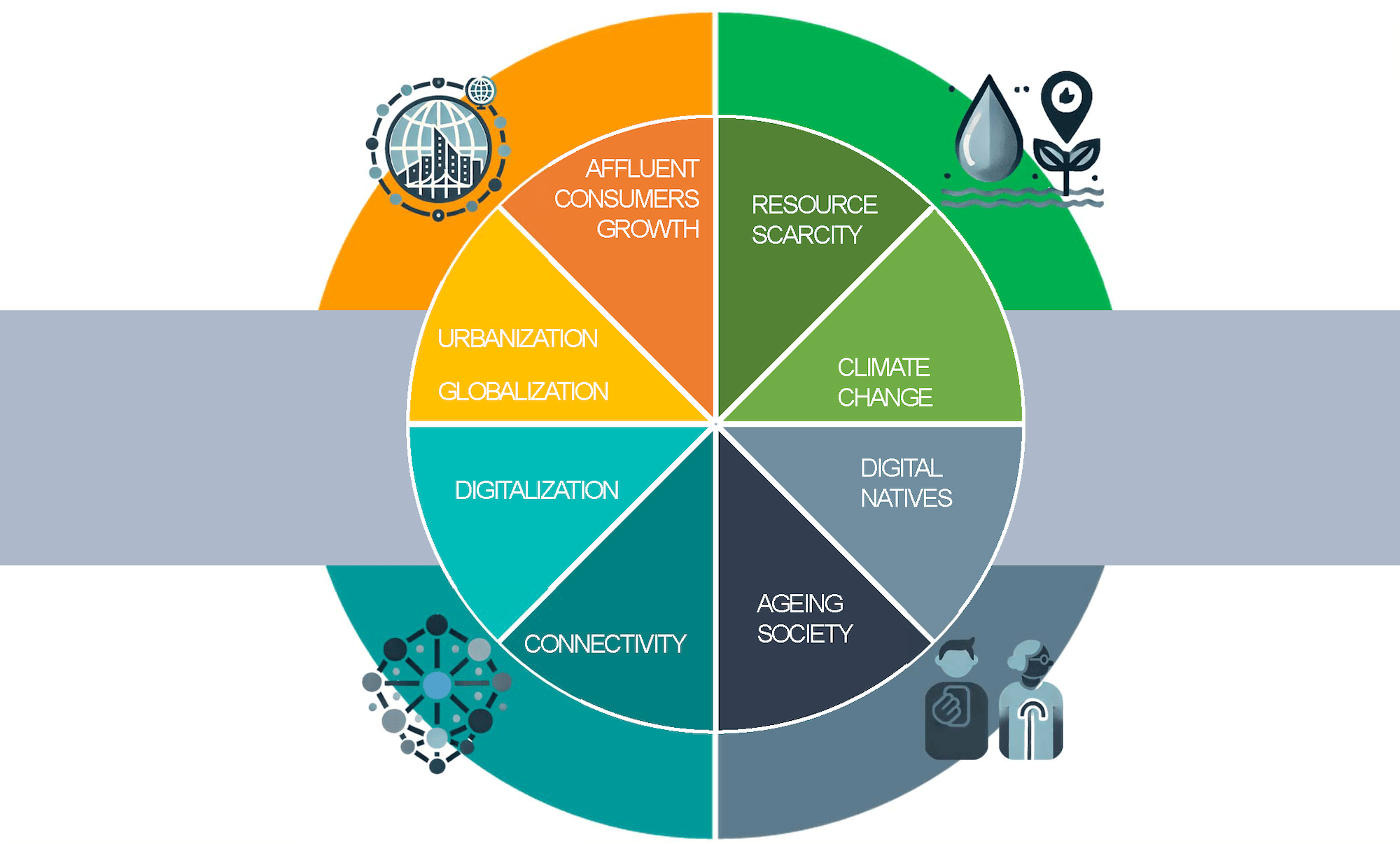

Amid this complex scenario, several megatrends are reshaping the global furniture landscape—trends that CSIL’s research constantly monitors and supports with evidence-based insights.

Among the most significant is the growing emphasis on sustainability and the circular economy. Consumers are increasingly attentive to the environmental impact of their purchasing decisions, prompting manufacturers to adopt more sustainable practices. CSIL’s recent survey of leading companies confirms a growing interest in the second-hand market, with firms investing in refurbishment, recycling, and resale initiatives—not only to reduce waste, but also to enhance brand value and respond to changing consumer values.

Digitalization represents another powerful driver of change. The rise of digital-native consumers, particularly Generation Z, is accelerating the shift toward online furniture sales and increasing demand for smart and connected products. Today, according to CSIL, e-commerce accounts for over 10% of global furniture sales. The market for smart furniture—characterized by connectivity, adaptability, and energy efficiency—is expected to grow rapidly, particularly in Europe, where annual growth rates of over 10% are projected through 2030.

Urbanization and evolving lifestyles are also altering the structure of demand. As populations concentrate in cities and homes become smaller and more flexible, there is a growing preference for modular, multifunctional, and ready-to-assemble furniture. The trend toward hybrid spaces—combining work, leisure, and family life—is also boosting demand for flexible designs, as well as for outdoor solutions that extend living spaces beyond the traditional home.

The segment of luxury and high-end furniture is experiencing notable growth. The global number of affluent consumers has increased significantly, especially in emerging markets. Between 2015 and 2023, the number of millionaires worldwide grew by an average of 7% per year, with the fastest expansion in Asia-Pacific. This is reflected in the expansion of the luxury furniture segment, which now accounts for approximately 14% of the global market.

Courtesy of

World Furniture

Magazine

Founded in Milan in 1980, CSIL is an independent research institute,

specialising in applied economics, industry competitiveness, small business,

market analysis, evaluation and regional development studies. CSIL partners are

highly qualified experts, including economists, engineers, business analysts,

statisticians, and experts in policy and project evaluation.

CSIL – Milan, Italy